Integrating GHG Accounting into Your Corporate ESG Strategy

Understanding Carbon Emissions and Their Impact

Every time a company powers up production lines, lights office buildings, or ships goods across the country, greenhouse gases (GHGs) are released. Often invisible but deeply consequential, these emissions contribute to climate change, now widely recognized as a global economic and social threat. From flooding that disrupts supply chains to heatwaves that halt operations, the impact is no longer theoretical. It's here, and businesses are feeling the consequences.

GHGs like carbon dioxide (CO₂), methane (CH₄), and nitrous oxide (N₂O) trap heat in the atmosphere, amplifying global warming. According to the IPCC, human activity has already caused approximately 1.1°C of warming since pre-industrial times, and without rapid emission reductions, the world could exceed 1.5°C within two decades (IPCC, 2023). For companies, this means rising regulatory pressure, increasing investor scrutiny, and shifting consumer expectations, all demanding urgent and transparent climate action.

One of the most effective ways for companies to begin managing their climate impact is through GHG accounting. Just like financial accounting helps understand money flow, GHG accounting reveals where emissions are coming from and where reductions are possible. This data becomes the bedrock for making smarter, future-proof decisions that align with environmental, social, and governance (ESG) goals.

What Is GHG Accounting and Why It Matters for ESG

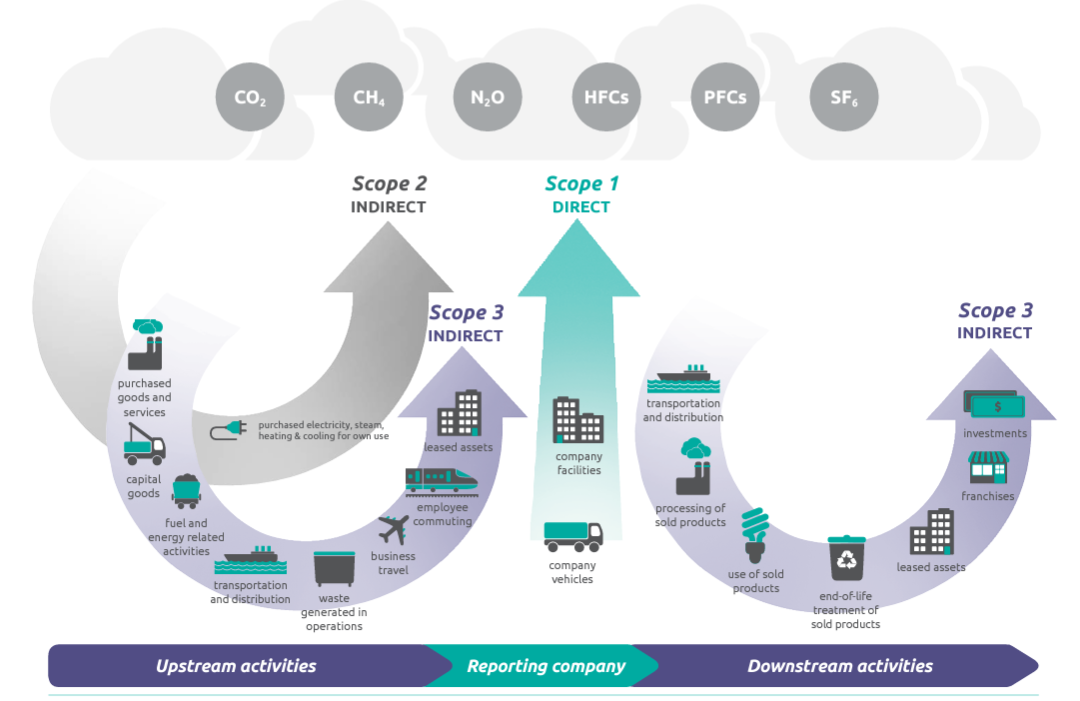

GHG accounting refers to the process of identifying, measuring, and reporting a company’s greenhouse gas emissions. Companies should adopt globally recognized standards like the GHG Protocol or ISO 14064 to ensure their process aligns with best practices. The most widely used framework, the GHG Protocol, classifies GHG emissions into three scopes: Scope 1 includes direct emissions from company-owned sources like fuel combustion in vehicles or on-site equipment. Scope 2 covers indirect emissions from purchased energy such as electricity or heat. Scope 3 captures all other indirect emissions, from employee commuting to the emissions embedded in your supply chain and investment portfolios (GHG Protocol, 2015).

In addition to the GHG Protocol, another widely adopted framework is ISO 14064, developed by the International Organization for Standardization. This standard provides a globally consistent approach to quantifying and reporting greenhouse gas emissions and removals. It is often favored for its flexibility and compatibility with third-party verification processes, making it especially useful for organizations aiming for internationally recognized carbon accounting (ISO 14064).

Most companies begin with Scopes 1 and 2 because the data is more readily available. However, Scope 3 often represents the largest slice of a company’s carbon footprint, up to 90% in some sectors like finance, retail, or logistics (McKinsey & Company, 2021). Ignoring Scope 3 leaves a major blind spot in ESG reporting and weakens credibility with investors, regulators, and the public.

Funfact! A 2023 report by BCG and CDP revealed that supply chain emissions were on average 26 times greater than emissions from direct operations. For some industries, Scope 3 emissions alone exceeded the entire CO₂ footprint of the EU in 2022.

When done well, GHG accounting supports every aspect of ESG. Environmental data becomes more accurate and actionable. Socially, companies show accountability to their workforce and communities, demonstrating transparency in how their operations affect the planet. On the governance front, robust emissions data allows boards and executives to track climate risks, set informed targets, and comply with emerging regulations like Indonesia’s POJK 51/POJK.03/2017 or the upcoming sustainability reporting regulations under OJK’s Sustainable Finance Roadmap Phase II (OJK, 2021). However, accountability is difficult to sustain without financial pressure. That’s why government support is crucial, not just in mandating disclosure but also in integrating sustainability into financial and capital market systems. After all, corporate action often follows where the money flows.

Too often, companies treat GHG accounting as just another reporting task. But its real power lies in guiding strategic decisions, from operational improvements to product design and supplier engagement. Companies that approach it this way build stronger ESG foundations and long-term resilience.

The Carbon Market and Its Role in Emissions Management

In today’s carbon economy, emissions are more than just an environmental issue, they’re a tradable commodity. Carbon markets offer companies the opportunity to manage their emissions profile by trading carbon credits and offsets. Internationally, these markets are divided into compliance and voluntary categories. The voluntary carbon market is where many companies start, with well-known standards like Verra’s Verified Carbon Standard (VCS) and Gold Standard, among others, providing a framework for project validation and carbon credit issuance. Companies can purchase credits from certified projects, such as forest conservation or renewable energy installations, to compensate for their residual emissions (UNEP, 2023). However, carbon offsets should be the last resort and used only after a company has measured and made efforts to reduce its emissions. High-integrity credits are essential, and recent reports highlight that some offsets do not deliver the promised climate benefits. That’s why adherence to standards like Verra or Gold Standard, combined with third-party verification, is critical (Carbon Neutral, 2024).

In Indonesia, to support its Nationally Determined Contribution (NDC) commitments under the Paris Agreement, the government has established its own carbon market mechanisms to align with national climate targets. One of the most relevant systems is the Sistem Registri Nasional Pengendalian Perubahan Iklim (SRN PPI), which includes the SPE-GRK (Sertifikat Penurunan Emisi Gas Rumah Kaca), a registry and certification system for verified emission reductions. This domestic framework enables Indonesian entities to claim and trade GHG reductions in a structured, transparent, and government-endorsed way (KLHK, 2023).

Understanding both international and national carbon markets is crucial for companies that want to operate responsibly. When integrated with credible GHG accounting, participation in systems like Verra and SPE-GRK helps businesses not only reduce emissions but also enhance credibility, stakeholder trust, and preparedness for future regulations.

Implementing GHG Accounting in Your Business

Starting GHG accounting begins with identifying where emissions come from across your operations. For example, through the GHG Protocol, calculating Scope 1 and 2 often involves gathering data from fuel use, electricity bills, and company vehicles. Scope 3 may include emissions from suppliers, business travel, and even product use. Data collection is a crucial next step. While some information is readily available internally, others, especially for Scope 3, may require engagement with suppliers or industry benchmarks. Start with what’s accessible and improve data quality over time. Many Indonesian companies begin with simple spreadsheets, internal data tracking, and guidance from publicly available GHG protocols or national technical guidelines. The key is to establish a consistent method for data gathering and make incremental improvements each year.

After data collection, the next step is selecting the appropriate emission factors. These factors convert activity data such as liters of fuel or kilowatt-hours of electricity into CO₂-equivalent emissions. Emission factors can come from international sources like the IPCC or national sources such as Indonesia’s Ministry of Environment and Forestry. Depending on the quality of the data, companies can apply Tier 1 (default global averages), Tier 2 (country-specific), or Tier 3 (company-specific, highly detailed) approaches. Choosing the right tier helps balance accuracy and feasibility, especially when data availability varies across scopes.

Verification adds credibility to the process. Whether done internally or via third-party assurance providers, ensuring the accuracy of your emissions data builds trust with regulators, investors, and other stakeholders. Once a solid GHG inventory is in place, businesses can use the insights to set targets, reduce emissions, and report performance as part of their ESG disclosures.

Common Pitfalls and Long-Term Benefits

A major pitfall is underestimating the complexity and importance of Scope 3 emissions. Many companies avoid it entirely, missing their largest emissions source and leaving themselves vulnerable to greenwashing claims. Others delay GHG accounting until they feel their data is perfect, yet iterative progress is far better than inaction.

There’s also the temptation to over-rely on offsets without internal reductions. This undermines credibility, especially in a landscape where green claims are under greater scrutiny. Businesses must prioritize reduction, followed by compensation, and clearly communicate both.

The long-term benefits, however, are significant. Companies that implement strong GHG accounting practices position themselves to comply with current and future regulations, such as IFRS S1 and S2 which certain industries are expected to comply with starting in 2024. They also gain a competitive edge with investors and consumers, both of whom increasingly value transparency, accountability, and climate leadership.

Moving from Insight to Action

GHG accounting is no longer a niche activity, it’s a strategic necessity. Done well, it becomes a cornerstone of ESG performance and long-term sustainability. Companies that begin now will not only meet rising expectations but also lead the transition to a low-carbon economy.

Whether you're just beginning or looking to refine your approach, now is the time to act. Seek support from professionals who understand both global standards and local regulations. With the right mindset, consistent practices, and a commitment to transparency, GHG accounting becomes more than just compliance, it becomes a catalyst for meaningful change.

References