GRESB

We support clients throughout the preparation and submission of GRESB Real Estate Assessments, ensuring a comprehensive and accurate representation of ESG performance across real estate funds and companies.

GRESB Real Estate Assessment

The GRESB Real Estate Assessment is a globally recognised ESG benchmark for the real estate sector. It evaluates sustainability performance across seven key areas, including management, policies and disclosure, risk management, monitoring and environmental management systems, stakeholder engagement, social performance, and governance.

Key Benefits

Participating in the GRESB Assessment enables asset managers to demonstrate their commitment to sustainability and responsible investment, while strengthening credibility with investors. GRESB benchmarks also provide valuable insights into investor expectations, helping organisations prioritise actions and make informed, strategic decisions to enhance ESG performance.

Our Services

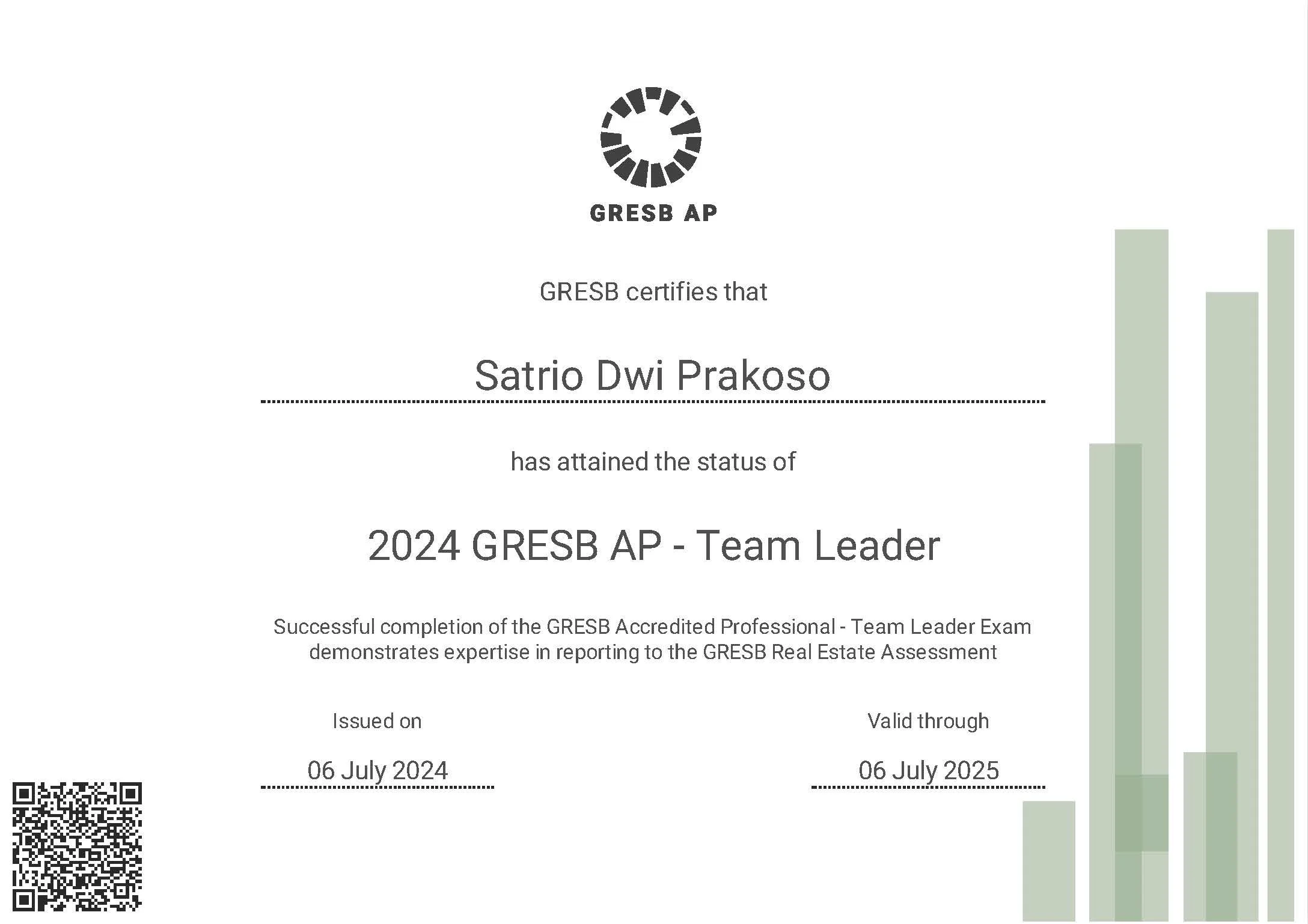

Our Founder and Principal Consultant, Satrio Prakoso, is a GRESB Accredited Professional (GRESB AP) with over four years of experience supporting real estate asset managers in GRESB submissions. He has successfully helped clients improve their performance from 3-star to 5-star ratings, increasing scores from 82 to 95, for both Standing Investments and Development portfolios.

Sustainahaus provides end-to-end GRESB support, from gap analysis and data verification to strategy development and submission. Contact us to learn how we can help you achieve higher GRESB scores and maximise the value of your ESG performance.